Find a Top Rated Bookkeeper Near You

- Trusted by +502,727 customers

- 100% verified ratings

- Absolutely free to use

How It Works

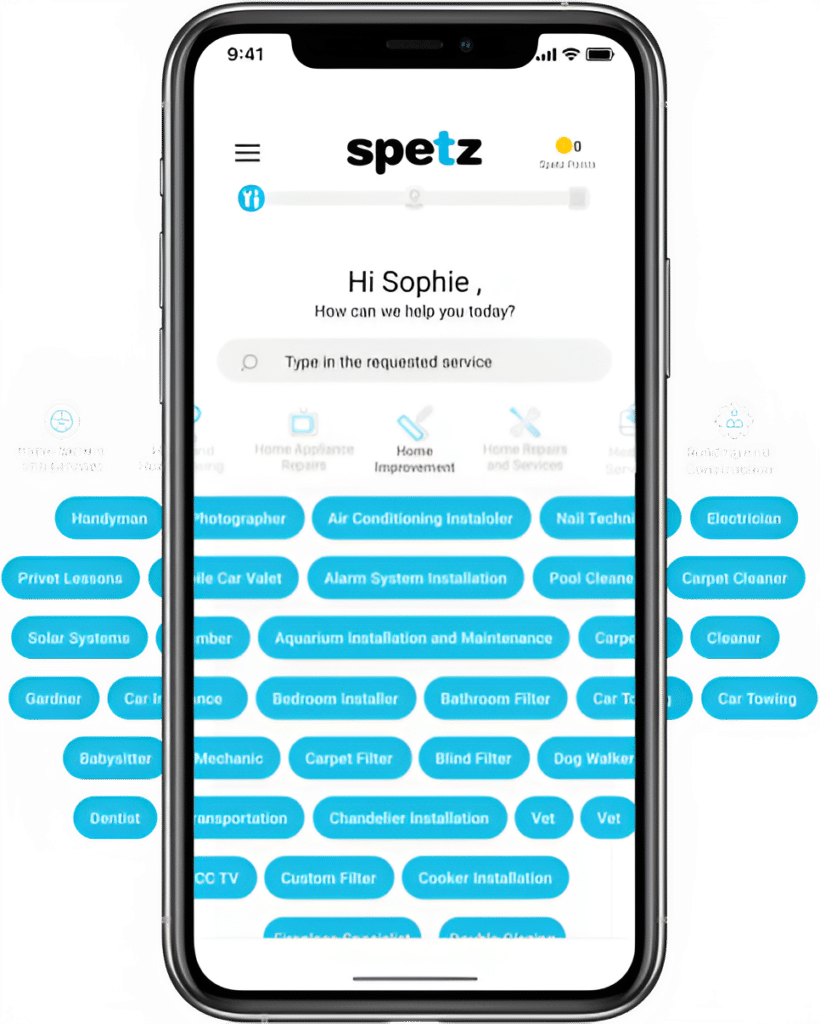

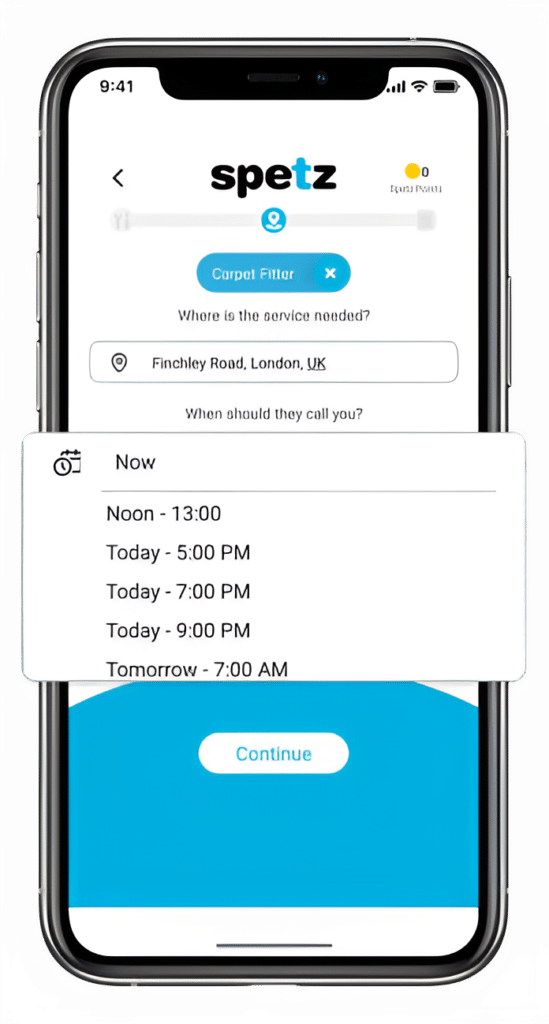

Make your free request

Simply enter the service you need, and your details then press "Spetz-it".

Get the job done

You'll be connected immediately to a nearby top-rated service provider.

Rate your specialist

Your rating is important. So you can help other customers get the best specialist too.

Bookkeeper

Frequently Asked Questions

Hiring the best bookkeeper near you involves a thorough process to ensure you find a skilled and trustworthy professional to handle your financial records. Here are the steps to help you in your search:

1. Define Your Needs: Determine what exactly you need from a bookkeeper. Do you need someone for basic data entry, financial analysis, tax preparation, or more complex financial tasks? Having a clear idea of your requirements will help you identify candidates with the right skills.

2. Qualifications and Experience: Look for bookkeepers with relevant qualifications such as a degree in accounting, finance, or a related field. Experience is crucial, so prioritize candidates with a proven track record in bookkeeping or accounting roles.

3. Certifications: While not mandatory, certifications like Certified Bookkeeper (CB) or QuickBooks Certified can demonstrate a higher level of expertise and commitment to the profession.

4. Ask for Recommendations: Reach out to your network, including friends, family, colleagues, or business associates, to ask if they know of any reliable bookkeepers. Personal recommendations can be invaluable.

5. Online Platforms: Utilize online job platforms like LinkedIn, Indeed, or specialized accounting job boards to find bookkeepers. These platforms often allow you to filter candidates based on location and experience.

6. Local Business Directories: Check local business directories or chamber of commerce websites for listings of bookkeepers in your area.

7. Interview Multiple Candidates: Don’t settle for the first candidate you come across. Interview multiple bookkeepers to assess their skills, experience, and personality fit for your business.

8. Ask the Right Questions: During interviews, ask questions that help you evaluate the candidate’s expertise, such as their familiarity with accounting software (QuickBooks, Xero, etc.), experience with tax preparation, and handling financial reports.

9. References: Request references from their previous clients or employers. Speaking with these references can provide insights into the candidate’s work ethic and professionalism.

10. Soft Skills: A bookkeeper’s interpersonal skills are important, especially if they’ll be working closely with you or your team. Effective communication, attention to detail, and reliability are essential traits.

11. Technology Proficiency: Modern bookkeeping often involves using various accounting software and tools. Ensure the bookkeeper is comfortable with the technology you use or intend to use.

12. Discuss Fees: Understand the candidate’s fee structure and ensure it aligns with your budget. Some bookkeepers charge hourly, while others offer fixed rates.

13. Trial Period: Consider starting with a short-term contract or probationary period to evaluate their performance before committing to a long-term arrangement.

14. Trust Your Instincts: If something doesn’t feel right during the hiring process, don’t ignore your gut feelings. Trust and transparency are crucial in a bookkeeper-client relationship.

15. Background Check: If you’re considering someone who will have access to sensitive financial information, consider conducting a background check to ensure their reliability.

16. Non-Disclosure Agreement (NDA): Depending on the sensitivity of your financial information, you might want to have the bookkeeper sign an NDA to protect your data.

Remember that finding the best bookkeeper takes time and effort. Don’t rush the process, as making the right choice can greatly benefit your business’s financial health in the long run.

A bookkeeper is a financial professional responsible for maintaining an accurate and organized record of a company’s financial transactions. Their primary role is to record and categorize financial data, ensuring that all financial activities are accurately documented for accounting and reporting purposes. Bookkeepers play a crucial role in helping businesses manage their finances and make informed decisions.

Here’s what a bookkeeper can do:

1. Record Transactions: Bookkeepers record all financial transactions, including sales, purchases, expenses, and payments, into the company’s accounting system. This involves keeping track of invoices, receipts, and other financial documents.

2. Categorize Transactions: They classify transactions into appropriate categories, such as assets, liabilities, revenue, and expenses. This categorization is essential for generating accurate financial statements.

3. Maintain Ledgers: Bookkeepers maintain various ledgers, such as the general ledger and subsidiary ledgers, to organize and track financial data for different accounts.

4. Bank Reconciliation: They reconcile bank and credit card statements with the company’s records to ensure that all transactions are accurately accounted for and to identify any discrepancies.

5. Accounts Receivable and Payable: Bookkeepers manage accounts receivable by tracking customer payments and following up on outstanding invoices. They also manage accounts payable by recording vendor bills and scheduling payments.

6. Payroll Processing: Some bookkeepers handle payroll tasks, including calculating employee wages, deducting taxes and benefits, and ensuring timely payment.

7. Financial Reporting: Bookkeepers prepare financial reports such as income statements, balance sheets, and cash flow statements. These reports provide a snapshot of the company’s financial health and performance.

8. Tax Preparation: Bookkeepers may assist in gathering the necessary financial data for tax preparation and working with accountants to ensure accurate and timely filing of taxes.

9. Data Entry and Accuracy: Accurate data entry is a core responsibility of bookkeepers. They need to ensure that all financial information is correctly inputted into the accounting system.

10. Financial Analysis: While not all bookkeepers perform this role, some with a deeper understanding of financial analysis might provide insights into cost-saving opportunities, revenue trends, and other financial aspects that can help with decision-making.

11. Compliance: Bookkeepers ensure that financial records are kept in accordance with relevant laws, regulations, and industry standards.

12. Communication: They often collaborate with other members of the finance team, including accountants, financial managers, and auditors, to ensure that financial records are accurate and up-to-date.

13. Software and Tools: Bookkeepers use various accounting software and tools to manage financial data efficiently. Proficiency in using these tools is essential.

14. Organizational Support: Small businesses or startups might rely on bookkeepers to assist with administrative tasks beyond finance, given their insight into the overall business operations.

In summary, a bookkeeper is responsible for accurately recording, categorizing, and organizing financial transactions to maintain clear and concise financial records. Their work forms the foundation for financial reporting, analysis, and decision-making within a business.

A bookkeeper can assist with various financial tasks and responsibilities within a business. Their expertise in recording, categorizing, and organizing financial transactions makes them valuable in several areas. Here are some of the jobs and tasks that a bookkeeper can help with:

1. Recording Financial Transactions: Bookkeepers are skilled in accurately recording day-to-day financial transactions such as sales, expenses, purchases, and payments.

2. Accounts Receivable: They can manage accounts receivable by invoicing customers, tracking payments, and following up on overdue invoices.

3. Accounts Payable: Bookkeepers can handle accounts payable by entering vendor bills, scheduling payments, and ensuring timely payment to suppliers.

4. Bank Reconciliation: They reconcile bank statements with the company’s records to identify any discrepancies, errors, or missing transactions.

5. Payroll Processing: Bookkeepers can calculate employee wages, deduct taxes and benefits, and ensure accurate and timely payroll processing.

6. Financial Reporting: They prepare essential financial reports like income statements, balance sheets, and cash flow statements that provide insights into the company’s financial performance.

7. Tax Documentation: Bookkeepers gather and organize financial data for tax preparation and work with accountants to ensure accurate tax filing.

8. Data Entry: Accurate data entry is a fundamental aspect of bookkeeping. They ensure all financial information is properly entered into the accounting system.

9. Expense Tracking: Bookkeepers can help monitor and categorize business expenses, making it easier to manage budgets and control costs.

10. Financial Analysis Support: While not all bookkeepers provide financial analysis, some may assist by preparing data for analysis, identifying trends, and providing input for decision-making.

11. General Ledger Maintenance: They maintain the general ledger, which is a master record of all financial transactions, ensuring accuracy and organization.

12. Cash Flow Management: Bookkeepers help monitor cash flow, ensuring that the business has enough funds to cover its expenses and obligations.

13. Financial Software Management: They manage accounting software and tools, ensuring that they are set up correctly and utilized effectively.

14. Expense Reimbursement: Bookkeepers can handle expense reimbursement processes for employees, ensuring proper documentation and compliance.

15. Documentation and Compliance: They maintain organized financial records that meet legal and regulatory requirements.

16. Communication with Accountants: Bookkeepers work closely with accountants to provide them with accurate and organized financial data, streamlining the accounting and auditing processes.

17. Financial Organization: Bookkeepers contribute to maintaining a well-organized financial system, making it easier for businesses to track their financial health.

18. Business Insights: By accurately recording financial data, bookkeepers provide the groundwork for generating insights into business operations, profitability, and potential areas of improvement.

Overall, bookkeepers play a crucial role in managing a company’s financial transactions, maintaining accurate records, and ensuring financial compliance. Their support extends to various financial aspects, helping businesses maintain financial clarity and make informed decisions.

The cost of hiring a bookkeeper in Australia can vary significantly depending on factors such as the bookkeeper’s level of experience, the complexity of the tasks involved, the location, and whether the work is being outsourced or done in-house. Here are some general guidelines to give you an idea of the potential costs:

1. Hourly Rates: Bookkeepers in Australia often charge hourly rates, which can range from AUD $25 to $80 or more per hour. Rates tend to be higher in major cities like Sydney, Melbourne, and Brisbane, compared to regional areas.

2. Monthly or Fixed Rates: Some bookkeepers offer monthly or fixed-rate packages based on the volume of transactions or the complexity of the work. These rates can range from AUD $200 to $1,000 or more per month.

3. Experience and Expertise: More experienced and certified bookkeepers generally charge higher rates due to their expertise in handling complex financial tasks and providing additional value to the business.

4. Type of Services: The scope of services required will impact the cost. Basic data entry and reconciliation might cost less compared to services that involve payroll processing, financial reporting, and tax preparation.

5. Business Size: The size of your business, including the number of employees, transactions, and the complexity of your financial records, can influence the cost. Larger businesses with higher transaction volumes might require more extensive bookkeeping services, leading to higher costs.

6. Outsourcing vs. In-House: Outsourcing bookkeeping services to freelance bookkeepers or agencies might be more cost-effective than hiring an in-house bookkeeper due to potential salary, benefits, and overhead costs associated with employees.

7. Geographical Location: The cost of living and business expenses in different regions of Australia can affect the rates that bookkeepers charge.

8. Software and Tools: If specific accounting software or tools are required for your business, the bookkeeper might charge extra for using or managing these tools.

It’s important to note that these are general estimates, and actual costs can vary widely. When considering the cost of hiring a bookkeeper, it’s recommended to:

– Get Quotes: Reach out to multiple bookkeepers in your area and provide them with information about your business’s needs to get accurate quotes.

– Evaluate Services: Consider what services are included in the fee. Some bookkeepers might provide additional services like financial analysis, tax advice, or consulting.

– Compare Value: While cost is a factor, also consider the value the bookkeeper brings to your business in terms of accuracy, compliance, and financial insights.

– Check References: Ask for references or reviews from other clients to assess the bookkeeper’s reliability and quality of service.

– Negotiate: Depending on your needs and the bookkeeper’s flexibility, there might be room for negotiation on the pricing structure.

Remember that hiring a skilled and trustworthy bookkeeper can greatly benefit your business by ensuring accurate financial records, helping with compliance, and providing valuable insights for decision-making.

When interviewing a local bookkeeper, asking the right questions is crucial to ensure you’re hiring a qualified and suitable professional for your business needs. Here’s a list of questions you can consider asking:

General Qualifications and Experience:

1. Can you provide a brief overview of your background and experience as a bookkeeper?

2. What types of businesses have you worked with in the past?

3. Are you certified or have any relevant qualifications in accounting or bookkeeping?

4. How long have you been working as a bookkeeper?

5. Can you provide references from clients you’ve worked with previously?

Technical Skills:

6. What accounting software are you proficient in? (QuickBooks, Xero, MYOB, etc.)

7. Have you worked with businesses in my industry before?

8. How familiar are you with local tax regulations and compliance requirements?

9. Can you handle multiple aspects of bookkeeping, such as accounts payable, accounts receivable, payroll, and financial reporting?

Services and Availability:

10. What specific bookkeeping services do you offer?

11. Are you available on a part-time or full-time basis? How many clients do you currently serve?

12. Can you handle both remote and on-site work?

13. What is your preferred mode of communication for updates and questions?

Data Security and Confidentiality:

14. How do you ensure the security and confidentiality of my financial data?

15. Are you willing to sign a non-disclosure agreement (NDA) to protect sensitive information?

Fees and Billing:

16. What is your fee structure? Do you charge hourly, monthly, or per project?

17. Are there any additional costs I should be aware of, such as software subscriptions or tools?

18. How do you handle billing and payment arrangements?

Communication and Reporting:

19. How often will you provide financial reports or updates?

20. Can you explain complex financial concepts in a way that is easy to understand for someone without an accounting background?

Problem-Solving and Decision-Making:

21. Can you give an example of a challenging financial issue you’ve resolved for a client?

22. How would you handle discrepancies or errors in financial records?

Compatibility and Fit:

23. How do you typically work with clients to understand their unique business needs?

24. Can you adapt to the specific accounting practices and preferences of my business?

25. What do you think sets you apart from other bookkeepers in the area?

Transition and Exit Plan:

26. How would you handle the transition if we decide to work together?

27. What’s your policy for ending our working relationship if it becomes necessary?

Asking these questions will help you assess the bookkeeper’s qualifications, expertise, and how well they align with your business’s needs.

It’s also an opportunity to gauge their communication style, problem-solving skills, and overall professionalism. Remember to take notes during the interview to help with your decision-making process.