Find a Top Rated Business Loans Near You

- Trusted by +502,727 customers

- 100% verified ratings

- Absolutely free to use

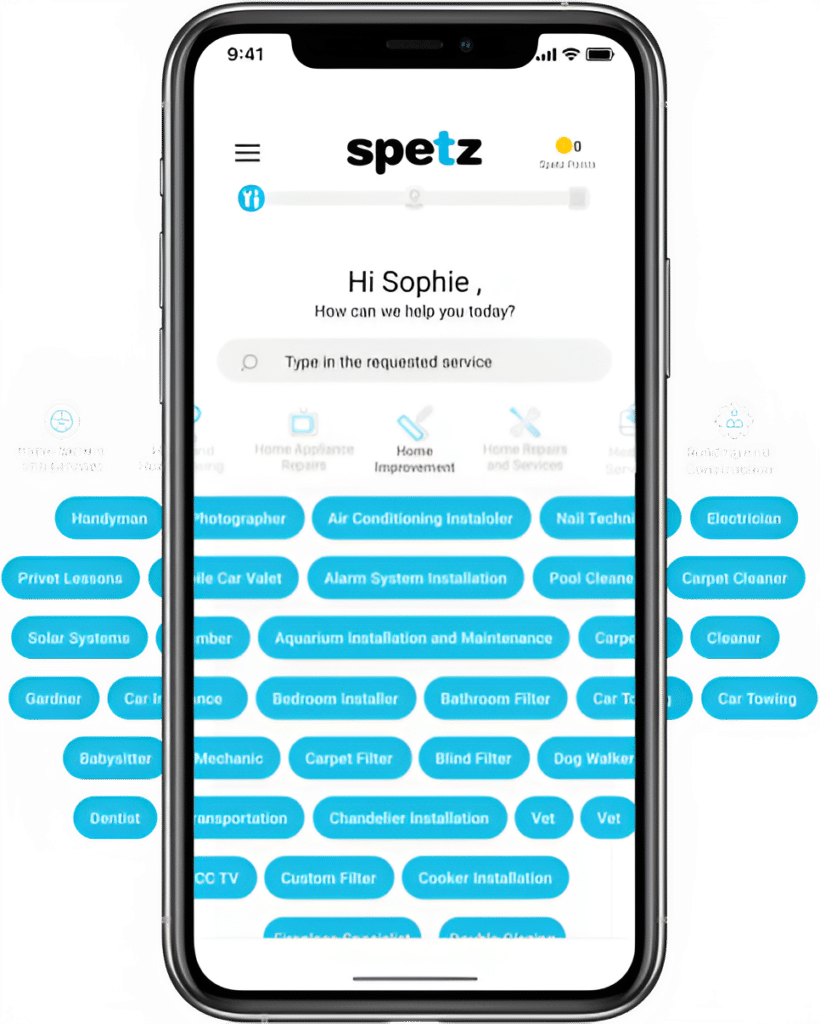

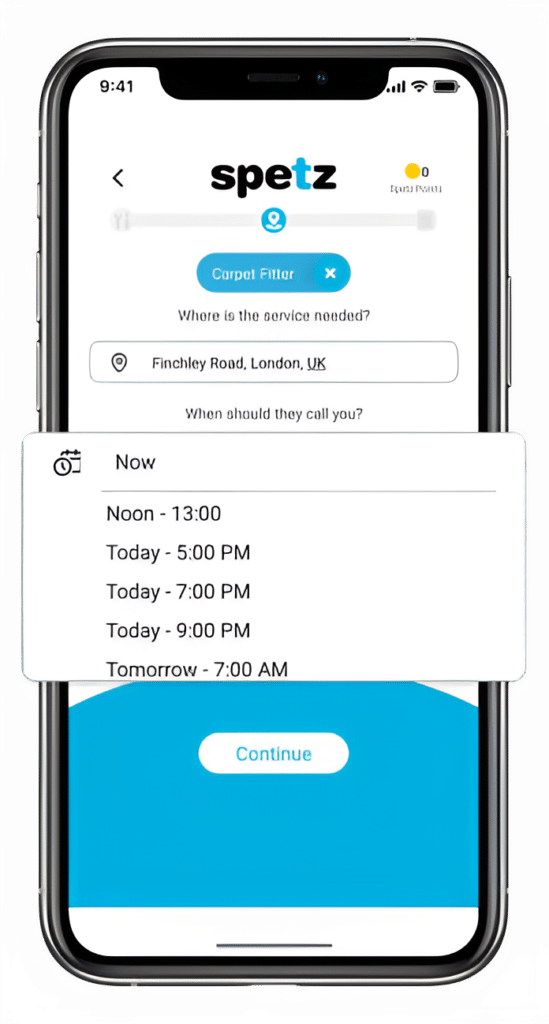

How It Works

Make your free request

Simply enter the service you need, and your details then press "Spetz-it".

Get the job done

You'll be connected immediately to a nearby top-rated service provider.

Rate your specialist

Your rating is important. So you can help other customers get the best specialist too.

Business Loans

Frequently Asked Questions

To hire the best business loan provider near you, follow these steps:

1. Assess Your Business Needs: Determine why you need a business loan and how much capital you require. Consider factors such as business expansion, equipment purchase, working capital, inventory management, or debt consolidation.

2. Understand Loan Options: Familiarize yourself with the various types of business loans available, such as term loans, lines of credit, equipment financing, invoice financing, SBA loans, merchant cash advances, and business credit cards. Understand the features, terms, and requirements of each loan type.

3. Research Local Lenders: Identify reputable lenders in your area by conducting online research, asking for recommendations from business associates, or seeking referrals from your financial advisor or accountant. Look for lenders with a track record of providing reliable financing solutions and excellent customer service.

4. Compare Loan Terms and Rates: Compare loan terms, interest rates, fees, repayment terms, and eligibility criteria offered by different lenders. Consider factors such as loan amount, repayment period, interest rates, origination fees, prepayment penalties, and collateral requirements.

5. Check Lender Reviews and Reputation: Research lender reviews, ratings, and testimonials from previous clients to assess their reputation and customer satisfaction levels. Look for feedback on factors such as loan approval process, customer service, transparency, and reliability.

6. Evaluate Eligibility Requirements: Determine whether you meet the eligibility criteria set by the lenders, such as minimum credit score, business revenue, time in business, collateral requirements, and industry restrictions. Choose lenders whose eligibility criteria align with your business profile and financial situation.

7. Gather Required Documentation: Prepare all necessary documentation and financial records required for the loan application process. Common documents may include business tax returns, financial statements, bank statements, business plan, legal documents, and personal identification.

8. Schedule Consultations or Meetings: Contact potential lenders to schedule consultations or meetings to discuss your financing needs, business goals, and loan options. Use this opportunity to ask questions, clarify terms, and gather additional information about the loan products and services offered.

9. Review Loan Offers and Terms: Review loan offers from multiple lenders, including interest rates, fees, repayment terms, and any other conditions. Compare the pros and cons of each offer to determine which loan best suits your business needs and financial objectives.

10. Negotiate Terms and Conditions: Negotiate with the lender to obtain favorable loan terms and conditions, such as lower interest rates, longer repayment periods, or waived fees. Be prepared to negotiate based on your creditworthiness, business performance, and relationship with the lender.

11. Read and Understand the Loan Agreement: Carefully review the loan agreement, including all terms, conditions, and legal obligations, before signing. Seek clarification on any unclear terms or provisions and ensure that you fully understand your rights and responsibilities as a borrower.

12. Submit Loan Application: Complete the loan application process by providing all required documentation and information accurately and promptly. Follow up with the lender to track the status of your application and address any additional requirements or inquiries.

13. Monitor Loan Progress and Communication: Stay in communication with the lender throughout the loan process and provide any requested updates or documentation promptly. Monitor the progress of your loan application and follow up as needed to ensure a timely and smooth approval process.

By following these steps and conducting thorough research, you can hire the best business loan provider near you to meet your financing needs and support your business growth and success.

A business loan is a financial product designed to provide businesses with access to capital to fund various business expenses, investments, or operations. Business loans can be used for a wide range of purposes, including:

1. Startup Capital: Business loans can provide funding to entrepreneurs and startups to cover initial startup costs, such as equipment purchases, inventory acquisition, marketing expenses, and operational expenses.

2. Working Capital: Business loans can help businesses maintain or increase their working capital, providing the necessary funds to cover day-to-day operating expenses, payroll, rent, utilities, and other ongoing costs.

3. Expansion and Growth: Business loans can support business expansion initiatives, such as opening new locations, launching new product lines, expanding production capacity, or entering new markets. The capital from a business loan can help businesses capitalize on growth opportunities and scale their operations.

4. Equipment Purchase: Business loans can be used to finance the purchase of new equipment, machinery, vehicles, or technology infrastructure needed to improve efficiency, productivity, and competitiveness.

5. Inventory Management: Business loans can assist businesses in managing their inventory levels by providing funds to purchase inventory in bulk, take advantage of bulk discounts, or meet seasonal demand fluctuations.

6. Debt Consolidation: Business loans can be used to consolidate existing business debts, such as high-interest loans, credit card debt, or vendor invoices, into a single loan with more favorable terms, lower interest rates, and structured repayment schedules.

7. Cash Flow Management: Business loans can help businesses smooth out cash flow fluctuations caused by seasonal fluctuations, cyclical demand patterns, or unexpected expenses. Access to additional capital can provide a financial cushion to cover cash flow gaps and maintain business continuity.

8. Marketing and Advertising: Business loans can finance marketing and advertising campaigns to promote products or services, increase brand awareness, attract new customers, and drive sales growth.

9. Business Acquisition or Merger: Business loans can facilitate business acquisitions, mergers, or buyouts by providing the necessary funds to purchase existing businesses, acquire competitors, or consolidate market share.

10. Business Restructuring or Turnaround: Business loans can support businesses undergoing restructuring, turnaround, or restructuring efforts by providing capital to implement strategic initiatives, improve operational efficiency, or overcome financial challenges.

Overall, business loans can serve as a valuable financial tool for businesses of all sizes and industries, providing the necessary capital to support growth, innovation, and resilience in today’s competitive business environment. However, it’s essential for businesses to carefully assess their financing needs, evaluate loan options, and ensure they can comfortably manage loan repayment obligations before proceeding with a business loan.

Business loans can assist with a wide range of business-related activities and initiatives across various industries. Here are some common jobs or tasks that business loans can help with:

1. Startup Costs: Providing capital to cover initial startup costs, including business registration fees, legal expenses, website development, and marketing efforts.

2. Working Capital: Supporting day-to-day operations by covering expenses such as payroll, rent, utilities, inventory purchases, and supplier payments.

3. Expansion and Growth: Funding expansion projects such as opening new locations, entering new markets, launching new product lines, or increasing production capacity.

4. Equipment Purchase: Financing the acquisition of machinery, tools, vehicles, or technology infrastructure needed to improve efficiency, productivity, and competitiveness.

5. Inventory Management: Assisting with the purchase of inventory in bulk, taking advantage of bulk discounts, or managing seasonal fluctuations in demand.

6. Marketing and Advertising: Funding marketing and advertising campaigns to promote products or services, increase brand awareness, attract new customers, and drive sales growth.

7. Business Acquisition or Merger: Providing capital for acquiring existing businesses, buying out competitors, or consolidating market share through mergers or acquisitions.

8. Debt Consolidation: Consolidating existing business debts into a single loan with more favorable terms, lower interest rates, and structured repayment schedules.

9. Cash Flow Management: Helping to smooth out cash flow fluctuations caused by seasonal variations, cyclical demand patterns, or unexpected expenses.

10. Renovation or Expansion: Financing renovation or expansion projects to improve facilities, upgrade infrastructure, or accommodate business growth.

11. Technology Investment: Investing in technology upgrades, software systems, or digital solutions to enhance operational efficiency, customer service, or competitive advantage.

12. Business Restructuring or Turnaround: Supporting businesses undergoing restructuring, turnaround, or reorganization efforts by providing capital to implement strategic initiatives, improve financial stability, or overcome challenges.

13. Emergency Expenses: Assisting with unexpected expenses such as equipment breakdowns, facility repairs, legal disputes, or natural disasters.

14. Seasonal Needs: Providing funds to cover seasonal expenses, build inventory ahead of peak demand periods, or bridge revenue shortfalls during slow seasons.

Overall, business loans can play a crucial role in helping businesses of all sizes and industries achieve their goals, navigate challenges, and seize opportunities for growth and success. However, it’s essential for businesses to carefully assess their financing needs, evaluate loan options, and ensure they can comfortably manage loan repayment obligations before proceeding with a business loan.

The cost of a business loan in Australia can vary depending on several factors, including the lender, the type of loan, the loan amount, the repayment term, and the borrower’s creditworthiness. Here are some common factors that can influence the cost of a business loan:

1. Interest Rates: Interest rates on business loans can vary widely depending on market conditions, the lender’s policies, and the borrower’s creditworthiness. Interest rates may be fixed or variable and can range from around 4% to 30% or more per annum.

2. Fees and Charges: Business loans may be subject to various fees and charges, including application fees, origination fees, processing fees, documentation fees, and late payment fees. These fees can add to the overall cost of the loan and should be considered when evaluating loan offers.

3. Repayment Terms: The repayment term of a business loan can affect the total cost of borrowing. Loans with longer repayment terms may have lower monthly payments but can result in higher total interest costs over the life of the loan. Conversely, loans with shorter repayment terms may have higher monthly payments but lower total interest costs.

4. Loan Amount: The amount of the loan can also impact the cost, with larger loan amounts typically attracting lower interest rates but higher fees. Lenders may offer better terms for larger loan amounts to incentivize borrowing.

5. Security/Collateral: Secured business loans, which require collateral such as property or equipment, may offer lower interest rates compared to unsecured loans. Lenders may also be more willing to lend larger amounts at favorable terms when the loan is secured.

6. Creditworthiness: The borrower’s credit history, credit score, and financial stability play a significant role in determining the cost of a business loan. Borrowers with excellent credit profiles may qualify for lower interest rates and better loan terms compared to those with less-than-perfect credit.

7. Market Conditions: Economic factors and market conditions can impact the cost of borrowing, with interest rates and lending conditions influenced by factors such as inflation, government policies, and overall economic performance.

It’s essential for business owners to carefully compare loan offers from multiple lenders, consider the total cost of borrowing, and evaluate the overall affordability and suitability of the loan for their business needs. Additionally, borrowers should review the loan agreement carefully, including the terms and conditions, interest rates, fees, repayment schedule, and any potential penalties or charges, to ensure they fully understand the cost of the loan before proceeding.

When considering a business loan from a local lender, it’s essential to ask the right questions to gather all necessary information and make an informed decision. Here are some questions to ask a local business loan provider:

1. What types of business loans do you offer?

– Understand the range of loan products available, including term loans, lines of credit, equipment financing, SBA loans, and merchant cash advances.

2. What are the eligibility criteria for your business loans?

– Inquire about the minimum requirements for credit score, business revenue, time in business, and any industry-specific restrictions.

3. What is the maximum loan amount you offer?

– Determine the maximum loan amount available to ensure it meets your financing needs.

4. What are the interest rates and terms for your loans?

– Ask about the interest rates, whether they are fixed or variable, and the repayment terms, including the loan duration and payment frequency.

5. What fees are associated with your business loans?

– Inquire about any application fees, origination fees, processing fees, prepayment penalties, or other charges associated with the loan.

6. Is collateral required for your loans?

– Understand whether the loan requires collateral and what type of assets can be used as collateral.

7. How long does the loan approval process typically take?

– Get an estimate of the time it takes to process and approve a loan application, from submission to funding.

8. What documents are required to apply for a business loan?

– Ask for a list of required documentation, such as financial statements, tax returns, business plans, and legal documents.

9. Can you provide references or testimonials from past clients?

– Request references or testimonials from other businesses that have obtained loans from the lender to gauge customer satisfaction and reliability.

10. What is your approach to customer service and support?

– Inquire about the lender’s customer service policies, responsiveness to inquiries, and availability to address any concerns or issues during the loan process.

11. Are there any special programs or incentives available for small businesses or specific industries?

– Check if the lender offers special loan programs, incentives, or discounts for small businesses, startups, minority-owned businesses, or businesses in certain industries.

12. What happens if I have difficulty making payments on the loan?

– Understand the lender’s policies for handling delinquent payments, late fees, default consequences, and options for loan modification or restructuring.

13. Are there any restrictions on how the loan proceeds can be used?

– Clarify any restrictions or limitations on how you can use the loan funds, such as specific business purposes or prohibited activities.

14. Can I speak with a loan officer or advisor to discuss my specific needs and options?

– Request a consultation or meeting with a loan officer or advisor to discuss your business goals, financial situation, and available loan options in more detail.

By asking these questions, you can gain valuable insights into the lender’s loan products, terms, and policies, helping you make an informed decision that aligns with your business needs and goals.