Find a Top Rated Mortgage Broker Near You

- Trusted by +502,727 customers

- 100% verified ratings

- Absolutely free to use

How It Works

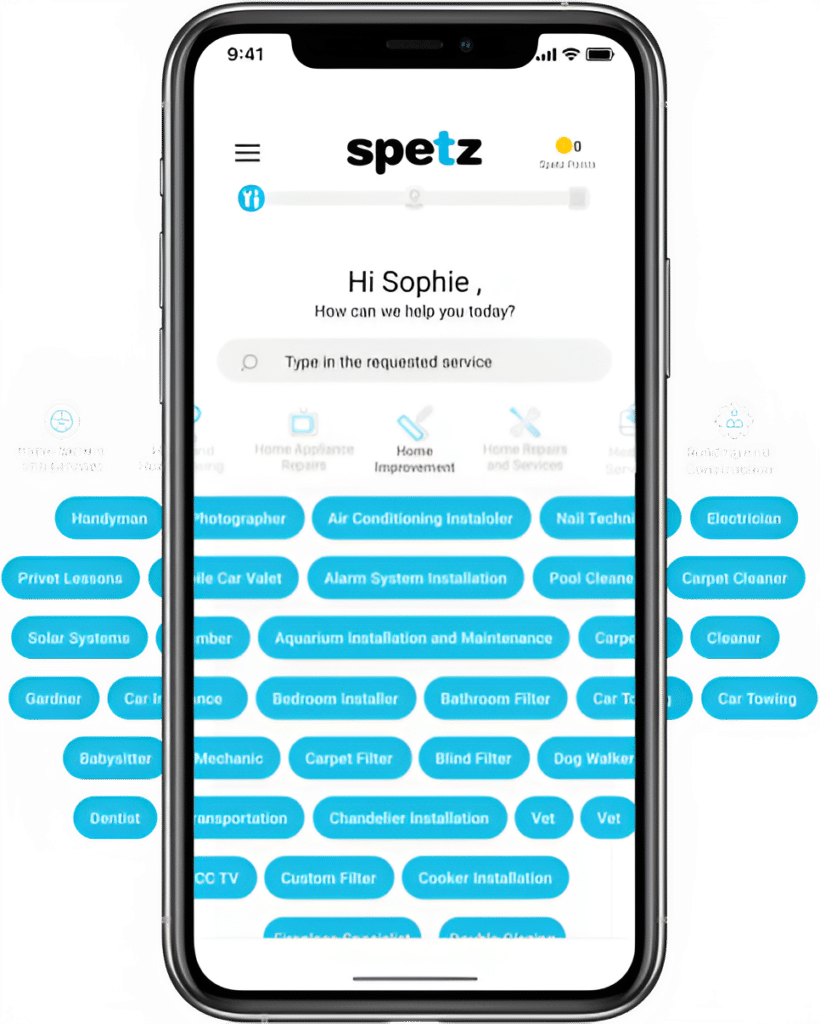

Make your free request

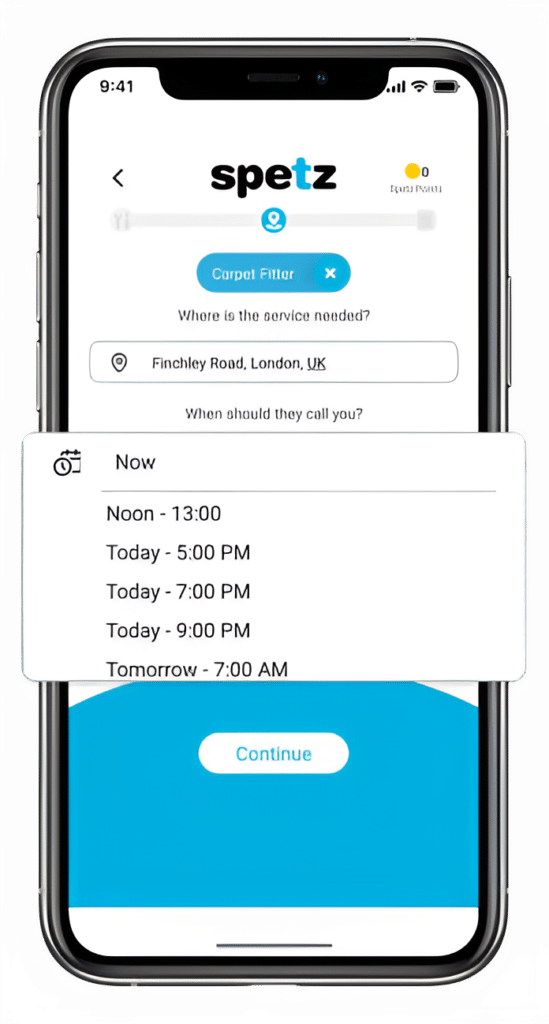

Simply enter the service you need, and your details then press "Spetz-it".

Get the job done

You'll be connected immediately to a nearby top-rated service provider.

Rate your specialist

Your rating is important. So you can help other customers get the best specialist too.

Mortgage Broker

Frequently Asked Questions

Hiring the best mortgage broker requires research, due diligence, and asking the right questions. Here’s a step-by-step guide to help you find and hire the best mortgage broker near you:

1. Research and Recommendations:

– Start by asking friends, family, and colleagues for recommendations. Personal experiences often provide valuable insights.

– Read online reviews and testimonials to get an idea of the broker’s reputation and client satisfaction.

2. Qualifications and Licensing:

– Ensure that the broker is licensed to operate in your state or territory. In Australia, for example, mortgage brokers should be licensed with the Australian Securities and Investments Commission (ASIC).

– Check if they are a member of industry associations like the Mortgage & Finance Association of Australia (MFAA) or the Finance Brokers Association of Australia (FBAA).

3. Interview Potential Brokers:

– Schedule face-to-face meetings or phone calls to discuss your needs.

– This will also give you a sense of their professionalism and communication style.

4. Ask the Right Questions:

– How many lenders do you work with, and can you provide a list?

– How do you earn your commission, and will you disclose the commission you receive from lenders?

– Can you explain the entire loan process and timeline?

– What types of loans do you think would best suit my situation?

– How long have you been in the industry?

– Can you provide references or testimonials from recent clients?

5. Transparency:

– A reputable broker should be transparent about their fees and commissions. They should be willing to explain how they get paid and if there are any costs to you.

6. Personalized Service:

– The best brokers will take the time to understand your financial situation, goals, and requirements. They should offer tailored advice and options based on your needs.

7. Communication:

– Assess how responsive the broker is. They should be available to answer questions, provide updates, and guide you throughout the process.

8. Check References:

– Reach out to past clients to hear about their experiences. Ask about the broker’s expertise, communication, and if there were any issues.

9. Trust Your Instincts:

– Beyond credentials and experience, trust your gut feeling. You want a broker who makes you feel comfortable and confident in their advice.

10. Document Everything:

– Make sure you get all agreements, recommendations, and other essential communications in writing.

11. Stay Informed:

– Even with a broker’s assistance, educate yourself about the mortgage process, types of loans, interest rates, and market conditions. This knowledge will help you make informed decisions and assess the quality of the advice you receive.

Once you’ve selected a mortgage broker, maintain open communication throughout the process. While they will handle the majority of the legwork, staying informed and engaged will ensure you get the best outcome for your financial situation.

A mortgage broker acts as an intermediary between individuals or businesses seeking a mortgage loan and lenders. They facilitate the process of obtaining a mortgage for property buyers, using their expertise and networks to find and negotiate the best loan terms on behalf of their clients.

Here’s a more detailed look at what a mortgage broker can do:

1. Assessment of Financial Situation:

– A mortgage broker will begin by evaluating your financial situation, which includes checking your credit score, income, debts, and overall financial capability.

2. Tailored Recommendations:

– Based on the assessment, the broker will recommend suitable mortgage products and lenders that fit your needs and financial situation.

3. Access to a Range of Lenders:

– Mortgage brokers have access to a broad range of lenders, from major banks to smaller credit unions and specialized lenders. This access allows them to find competitive rates and terms that might not be readily available to the general public.

4. Loan Application:

– They will assist you in completing the necessary paperwork and submitting the loan application to lenders.

5. Negotiation:

– Mortgage brokers can negotiate with lenders to secure favorable interest rates, terms, and conditions for your loan.

6. Guidance Through the Process:

– They will guide you through the entire mortgage process, from pre-approval to closing, ensuring that you understand each step.

7. Cost Savings:

– By leveraging their relationships with lenders and understanding of the market, brokers can often secure mortgage terms that might be more favorable than what an individual could obtain directly.

8. Updates on Loan Progress:

– The broker will keep you updated on the progress of your loan application and coordinate between you, the lender, and other parties involved in the mortgage process.

9. Explaining Terms and Conditions:

– They will clarify any terms, conditions, or fees associated with the mortgage, ensuring that there are no surprises.

10. Post-Settlement Services:

– Some brokers also offer services after the loan has been settled, like assisting with refinancing or providing advice if your financial situation changes.

It’s essential to understand that while mortgage brokers can offer a range of loan options from various lenders, they might not have access to every lender or loan type in the market. Therefore, it’s beneficial to do some research independently as well.

Also, while many mortgage brokers are compensated through commissions from lenders (meaning you don’t pay them directly), some might charge fees to their clients. Always ensure clarity regarding any costs or fees associated with their services.

A mortgage broker is a professional who specializes in assisting clients with the mortgage loan process. Their main objective is to find the best loan product for a client based on their financial situation and needs. Here’s a breakdown of the specific jobs or tasks a mortgage broker can help with:

1. Financial Assessment:

– Evaluate your financial status, which includes your income, expenses, debts, and credit score.

– Determine your borrowing capacity based on your financial situation.

2. Mortgage Recommendations:

– Suggest appropriate mortgage products and lenders based on your needs and financial standing.

– Explain the pros and cons of various loan types, such as fixed-rate, variable-rate, interest-only, etc.

3. Loan Pre-approval:

– Assist in obtaining a pre-approval, which can give you a better idea of how much you can borrow and show sellers that you’re a serious buyer.

4. Loan Application:

– Help complete and submit the mortgage application on your behalf.

– Gather necessary documentation, such as proof of income, employment verification, and other relevant paperwork.

5. Rate Negotiation:

– Leverage relationships with lenders to negotiate better interest rates or terms for your loan.

6. Liaison with Lenders:

– Act as the main point of contact between you and potential lenders.

– Address any concerns or queries lenders might have regarding your application.

7. Clarifying Mortgage Terms:

– Explain all aspects of the mortgage agreement, ensuring you understand the terms, interest rates, fees, and other details.

8. Coordination with Other Professionals:

– Collaborate with real estate agents, conveyancers, solicitors, valuers, and other professionals involved in the property buying process.

9. Post-approval Follow-up:

– Assist with any tasks after the loan approval, such as meeting conditions set by the lender or ensuring timely settlement.

10. Refinancing:

– If you want to refinance your current mortgage, a broker can help you find a better deal or a loan product more suited to your changing needs.

11. Property Investment Advice:

– For those looking to invest in property, brokers can provide insights on the best loan products for investment purposes.

12. Updates on Market Trends:

– Keep you informed about market trends, interest rate movements, and new loan products or features that might benefit you.

Remember, the specific tasks a mortgage broker can assist with might vary depending on their level of expertise, the services they offer, and the complexity of your financial situation or property transaction. Always discuss and clarify the scope of their services upfront.

As of my last knowledge update in September 2021, the cost of using a mortgage broker in Australia can vary. Mortgage brokers in Australia typically don’t charge upfront fees to borrowers for their services. Instead, they are compensated by receiving a commission from the lenders when they successfully help a borrower secure a mortgage.

The commission structure and amounts can vary between different lenders and mortgage products. This means that the cost of using a mortgage broker is often indirectly incorporated into the loan terms offered by the lender. It’s important to note that while mortgage brokers don’t charge you directly, their compensation can be influenced by the loans they recommend, so it’s always a good idea to do your own research as well.

Keep in mind that the situation might have changed since my last update in September 2021. It’s recommended to check with local sources or directly contact mortgage brokers to get the most up-to-date information regarding their fees and commissions.

When meeting with a mortgage broker in Australia, asking the right questions can help you make informed decisions about your home loan. Here are some important questions to consider asking:

1. Qualifications and Experience:

– How long have you been working as a mortgage broker?

– Are you a member of any industry associations or professional organizations?

– Do you have experience working with clients in situations similar to mine?

2. Lender Relationships:

– Which lenders do you work with? Can you provide a range of options?

– How do you select lenders for your clients?

– Do you have access to loans from a wide variety of lenders, including major banks, credit unions, and non-bank lenders?

3. Loan Recommendations:

– Based on my financial situation and goals, what type of loan do you recommend for me?

– Can you explain the different loan options available and their features?

– How will you ensure that the recommended loan aligns with my needs and preferences?

4. Interest Rates and Fees:

– What are the current interest rates for the loan options you’re recommending?

– What fees are associated with the loans? (e.g., application fees, ongoing fees, exit fees)

– Can you provide a breakdown of the estimated costs involved in obtaining the loan?

5. Loan Features:

– Can you explain any special features or benefits of the loan options you’re suggesting?

– Are there any restrictions, penalties, or limitations that I should be aware of?

– How flexible are these loans if my circumstances change?

6. Documentation and Process:

– What documents will I need to provide for the loan application?

– Can you walk me through the loan application process and the timeline involved?

– How will you assist me in gathering and submitting the necessary paperwork?

7. Potential Savings and Benefits:

– How can your services benefit me compared to going directly to a lender?

– Can you provide examples of how you’ve helped clients save money or find better loan options?

8. Commission and Compensation:

– How are you compensated for your services? Do you receive commissions from lenders?

– Will you disclose the commission you receive from the lender for the recommended loan?

– Are there any potential conflicts of interest that I should be aware of?

9. Loan Approval and Settlement:

– How will you assist in managing the loan approval and settlement process?

– What steps will you take to ensure a smooth and timely settlement?

10. Client References:

– Can you provide references or testimonials from clients you’ve worked with recently?

– Do you have any online reviews or ratings that I can check?

Remember that these questions are just a starting point. Feel free to customize them based on your specific needs and concerns. A good mortgage broker should be open, transparent, and willing to answer all your questions to help you make the best decision for your financial situation.