Find a Top Rated Personal Loans Near You

- Trusted by +502,727 customers

- 100% verified ratings

- Absolutely free to use

How It Works

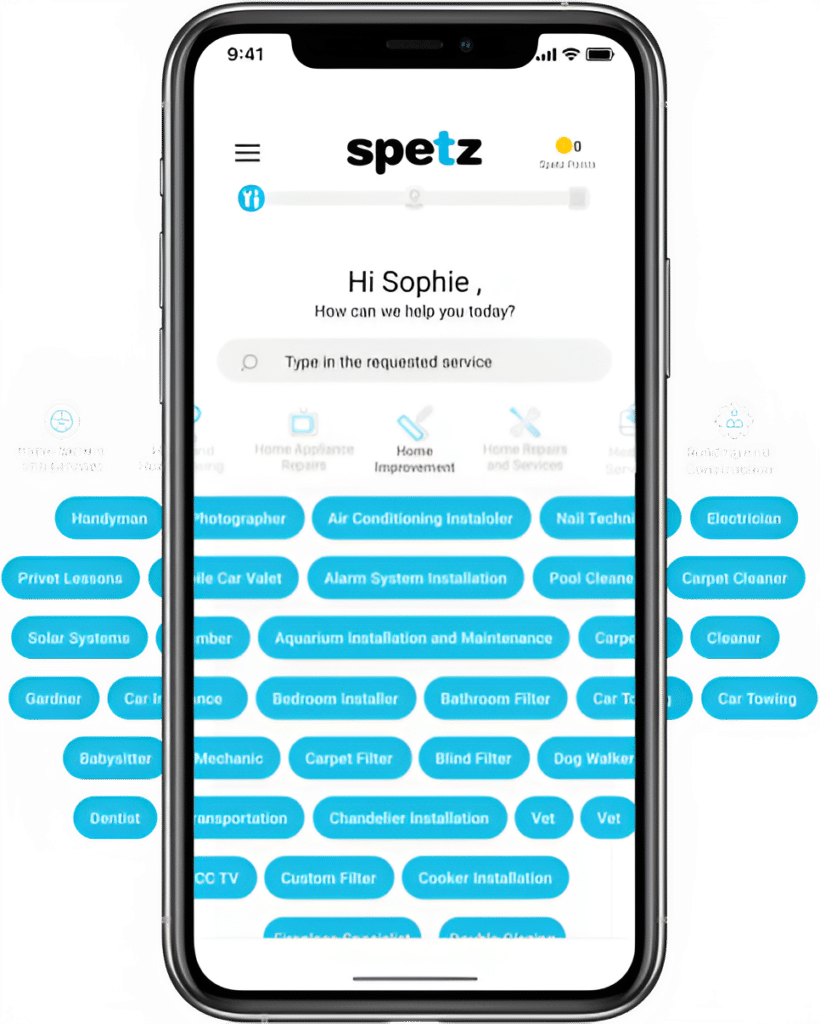

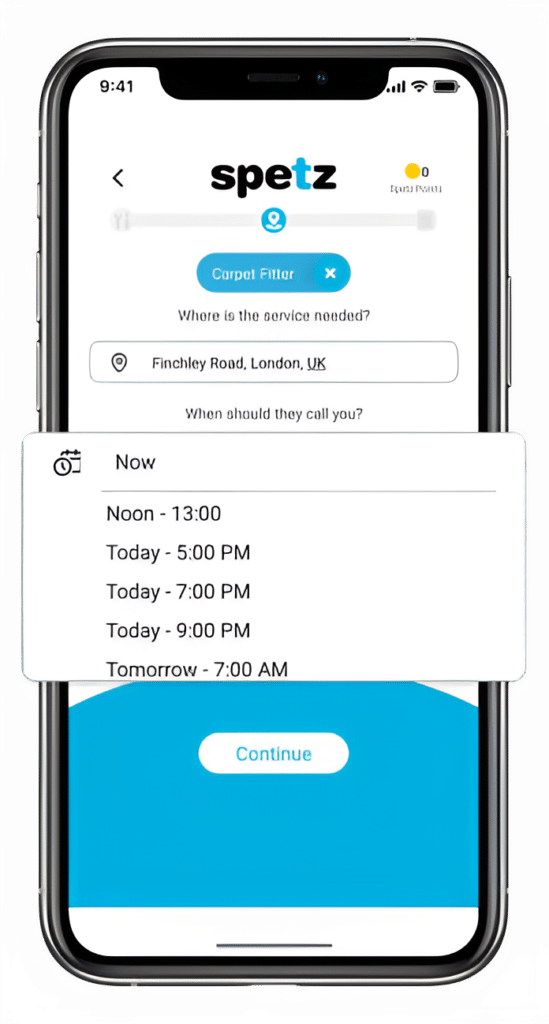

Make your free request

Simply enter the service you need, and your details then press "Spetz-it".

Get the job done

You'll be connected immediately to a nearby top-rated service provider.

Rate your specialist

Your rating is important. So you can help other customers get the best specialist too.

Personal Loans

Frequently Asked Questions

It seems there might be a bit of confusion in the phrasing. Personal loans aren’t typically something you hire, but rather a financial product you apply for from a bank, credit union, or other financial institutions.

If you’re looking to obtain the best personal loan near you, here are some steps and considerations to guide you:

1. Determine Your Needs:

– Decide how much money you need.

– Understand the purpose of the loan (e.g., home renovations, debt consolidation, a major purchase).

– Consider the time frame in which you can realistically repay the loan.

2. Research Different Lenders:

– Traditional banks and credit unions.

– Online lenders.

– Peer-to-peer (P2P) lending platforms.

– Always ensure that the lender is reputable and not involved in predatory lending practices.

3. Check Interest Rates:

– Interest rates can vary significantly between lenders.

– Be aware that the rates advertised might not be the rate you’re offered; it can be influenced by your credit score, income, and other factors.

– Understand whether the interest rate is fixed (it stays the same for the duration of the loan) or variable (it can change).

4. Understand Fees and Charges:

– Some loans come with origination fees, early repayment penalties, or late payment fees. Ensure you’re aware of all potential charges.

5. Check Loan Terms:

– Loan duration can vary, from short-term loans (e.g., 12 months) to longer terms (e.g., 7 years).

– Understand the monthly repayment amounts and ensure they’re affordable for you.

6. Review Loan Flexibility:

– Can you make extra payments without penalties?

– Is there an option for a payment holiday if you encounter financial difficulties?

7. Check Your Credit Score:

– Your credit score will influence your ability to obtain a loan and the interest rate you’re offered.

– You can request a free annual credit report from major credit reporting agencies to check for any errors or issues.

8. Read Reviews:

– Look for reviews or testimonials from other customers. This can provide insights into the lender’s customer service and trustworthiness.

9. Gather Necessary Documentation:

– Most lenders will require proof of income, identity verification, and possibly other documents. Prepare these in advance to streamline the application process.

10. Ask Questions:

– Don’t hesitate to ask the lender any questions about the loan product, terms, fees, or your eligibility.

11. Compare Multiple Offers:

– It’s wise to get loan quotes from multiple lenders to ensure you’re getting the best deal. However, be cautious about having too many hard inquiries on your credit report in a short time, as it might lower your credit score.

12. Read the Fine Print:

– Before finalizing and signing a loan agreement, thoroughly read all terms and conditions. If something is unclear, seek clarification.

Remember, while personal loans can be a useful tool for managing finances, they also come with the responsibility of repayment. Always ensure you’re borrowing within your means and have a clear plan for repayment. If in doubt, consider consulting with a financial advisor.

A personal loan is a type of unsecured loan provided by financial institutions, such as banks, credit unions, or online lenders. Because they’re typically unsecured, they don’t require collateral like a home or car. Instead, they’re based on the borrower’s creditworthiness.

Here’s a breakdown of what a personal loan is and its primary functions:

What is a Personal Loan?

1. Unsecured Loan: Most personal loans are unsecured, meaning you don’t have to pledge any assets as collateral. However, because there’s no collateral, these loans might have higher interest rates than secured loans.

2. Fixed Amount: Personal loans are for a fixed amount that’s determined by your need and your creditworthiness. The amount can range from a few hundred to several tens of thousands of dollars.

3. Fixed Interest Rate: Most personal loans come with a fixed interest rate, meaning the rate remains constant for the duration of the loan. Some lenders do offer variable-rate personal loans.

4. Fixed Term: Personal loans usually have a fixed term, which means you have a set period (like 2, 5, or 7 years) to repay the loan. Monthly payments remain consistent throughout the loan term.

5. Credit-Based: Your credit score, income, employment status, and other financial factors will influence your eligibility for a personal loan and the interest rate you’re offered.

What Can a Personal Loan Do? (Common Uses)

1. Debt Consolidation: One of the most common uses. If you have multiple debts (like credit card balances) with high interest rates, you can take out a personal loan to pay them off. This way, you’ll have just one fixed monthly payment, often at a lower interest rate.

2. Medical Expenses: Cover unforeseen medical expenses that aren’t covered by insurance.

3. Home Renovation: If you don’t want to take out a home equity loan or don’t qualify for one, a personal loan can fund home improvement projects.

4. Major Purchases: Whether it’s buying a new appliance, a car, or any other significant purchase, a personal loan can help spread out the cost.

5. Weddings and Events: Cover expenses for major life events like weddings, funerals, or family reunions.

6. Vacations: Fund a holiday or travel.

7. Moving Costs: If you’re relocating, especially over long distances, a personal loan can help cover these expenses.

8. Emergency Expenses: In case of unexpected situations, like urgent car repairs or home damages.

9. Education: While there are student loans specifically for this purpose, some might use personal loans to cover educational expenses.

10. Business: Some budding entrepreneurs use personal loans to cover startup costs or business expenses.

It’s crucial to understand that while personal loans can be a helpful tool in managing finances, they come with a responsibility. They need to be repaid with interest, and failing to do so can harm your credit score and lead to other financial consequences. Always assess your financial situation and ensure you can meet the repayment terms before taking out a personal loan.

A personal loan is a versatile financial product that can help fund various needs or expenditures. While the term jobs typically refers to professions or tasks, in the context of what personal loans can assist with, we can look at jobs as the various purposes or reasons people might take out a personal loan. Here are some of the jobs or purposes a personal loan can assist with:

1. Debt Consolidation: Combining multiple high-interest debts, especially credit card balances, into a single loan with a potentially lower interest rate. This can simplify finances by having just one monthly payment.

2. Home Renovations: Funding home improvement projects, repairs, or extensions when homeowners might not want to take out a home equity loan or don’t have enough equity in their homes.

3. Medical Emergencies: Covering unexpected medical expenses that might arise due to surgeries, treatments, or any other health-related issues not covered by insurance.

4. Travel and Vacations: Funding travel costs for a much-needed holiday or to visit family and friends.

5. Weddings: Covering expenses related to weddings, including venue booking, catering, clothing, and honeymoon.

6. Educational Expenses: While there are specialized student loans, some individuals might opt for a personal loan to fund tuition, books, accommodation, or other education-related costs.

7. Vehicle Purchase or Repair: Buying a new or used car, motorcycle, or even repairing an existing vehicle.

8. Relocation: Assisting with the costs related to moving homes, especially for long-distance relocations, including transportation, initial rental costs, or deposits.

9. Emergencies: Covering unexpected expenses, such as urgent repairs at home, replacement of essential appliances, or other unforeseen costs.

10. Business Startup or Expansion: Some individuals might take out personal loans to fund the starting of a new business, purchase inventory, or cater to other business-related expenses.

11. Funerals: Helping with the expenses related to the death of a loved one, which can be significant and unexpected.

12. Legal Fees: Covering costs related to legal matters, including attorney fees, settlements, or other related expenses.

13. Personal Growth: Attending seminars, workshops, or courses that might not be strictly academic but contribute to personal development.

14. Purchasing Appliances or Furniture: For buying essential household items or upgrading existing ones.

It’s essential to note that while personal loans offer flexibility and can cater to various needs, borrowers should be cautious. It’s vital to understand the terms of the loan, ensure the interest rate is competitive, and most importantly, make sure the monthly payments fit within the budget to avoid financial strain.

The cost of a personal loan in Australia is determined by various factors, primarily the interest rate, loan amount, and the term (length) of the loan. Apart from the principal amount borrowed, borrowers will need to pay interest, and there may be other fees associated with the loan.

Here are the main components to consider:

1. Interest Rates: This is the primary cost of a personal loan. Rates can vary widely based on the lender, your creditworthiness, loan amount, and term. As of my last training data which extends up to September 2021:

– Personal loan interest rates in Australia typically ranged from around 4% p.a. to 20% p.a. or higher.

– Secured loans (those backed by an asset like a car) often have lower rates than unsecured loans.

2. Establishment Fees: Many lenders charge an upfront fee to process and set up your loan. This can be a fixed amount or a percentage of the loan amount.

3. Monthly or Annual Fees: Some loans come with ongoing fees that add to the cost over time.

4. Early Repayment Fees: If you want to pay off your loan earlier than the set term, some lenders might charge you a fee.

5. Late Payment Fees: If you miss a payment or make a late payment, lenders typically charge a fee.

6. Other Fees: These can include redraw fees (if you want to borrow back some of what you’ve paid off), direct debit dishonor fees, and more.

When considering the cost of a personal loan, it’s essential to look at the comparison rate. In Australia, the comparison rate is a tool to help consumers identify the true cost of a loan. It’s a rate that includes both the interest rate and most fees and charges relating to a loan, combined into a single percentage figure. This can help borrowers compare loans more easily.

To get a clear idea of the current costs of personal loans in Australia, you should:

– Compare Rates Online: There are many comparison websites where you can check the current rates and terms offered by various lenders.

– Contact Banks or Credit Unions Directly: Ask for their current rates, fees, and loan terms.

– Check Your Eligibility: Your personal credit score and financial situation will significantly influence the rate you’re offered, so it’s a good idea to get a quote or pre-approval.

Lastly, always read the fine print. Ensure you understand all fees, charges, and terms before agreeing to a personal loan.

When you’re considering taking out a personal loan, it’s essential to gather as much information as possible to make an informed decision. Here are some questions you should ask your local lender or bank when inquiring about personal loans:

1. What’s the Interest Rate?

– Is the interest rate fixed or variable?

– If it’s variable, how often can it change and by how much?

2. Are There Any Fees?

– Is there an establishment or application fee?

– Are there any monthly or annual fees?

– What are the fees for making extra payments or paying off the loan early?

– Are there any fees for missed or late payments?

3. What’s the Loan Term?

– How long will I have to repay the loan?

– Are there benefits to choosing a shorter or longer term?

4. Is the Loan Secured or Unsecured?

– If it’s secured, what can be used as collateral?

– What happens if I default on a secured loan?

5. What’s the Total Cost of the Loan?

– Including interest and all fees, how much will I have paid by the end of the loan term?

6. How Flexible Are the Repayment Options?

– Can I choose to make weekly, fortnightly, or monthly repayments?

– Can I make extra payments without incurring fees?

7. What’s the Comparison Rate?

– This rate includes both the interest rate and most fees and charges relating to a loan, giving you a more complete picture of the loan’s cost.

8. Is There a Cooling-off Period?

– Is there a period after signing the loan agreement during which I can cancel the loan without penalty?

9. How Quickly Can the Loan be Approved and Funds Released?

– If you need the money urgently, it’s essential to know how long the process will take.

10. How’s the Customer Service?

– Is it easy to contact the lender?

– Do they have a good reputation for handling queries and concerns?

11. Are There Any Penalties for Defaulting on the Loan?

– Understanding the consequences of missed payments is crucial.

12. Can I Refinance or Consolidate This Loan in the Future?

– If your financial situation changes, it’s good to know your options.

13. Do You Offer Loan Protection Insurance?

– This insurance can help cover your repayments if you face unexpected hardships.

14. What Documents Do I Need to Apply?

– Be prepared by knowing what identification, financial documents, or other paperwork is required.

15. What’s the Process if I Face Financial Hardship During the Loan Term?

– Understanding your lender’s policies can give you peace of mind.

Before committing to any personal loan, always do your research. Read online reviews, compare offers from multiple lenders, and, if necessary, seek advice from a financial advisor. It’s essential to ensure the loan terms suit your financial situation and that you’re getting the best deal possible.